Unveiling the Art of Pricing and Risk Management: A Comprehensive Guide for FX and Interest Rate Portfolios

In today's dynamic financial landscape, navigating the complexities of pricing and risk management for foreign exchange (FX) and interest rate portfolios has become imperative for financial institutions seeking sustained profitability and stability. This comprehensive article delves into the intricacies of pricing and risk management, providing a comprehensive guide for local and global institutions alike.

Pricing FX and Interest Rate Portfolios

Pricing financial instruments is a cornerstone of successful portfolio management. For FX and interest rate portfolios, accurate pricing underpins decision-making, risk assessment, and performance evaluation. Various pricing models exist, each with its strengths and limitations.

4.4 out of 5

| Language | : | English |

| File size | : | 18443 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 498 pages |

FX Pricing Models

Spot Rate Models: These models assume no uncertainty in future exchange rates, providing a straightforward pricing mechanism.

Forward Rate Models: These models incorporate forward rates to account for expected changes in exchange rates over time, offering a more dynamic pricing approach.

Stochastic Volatility Models: These models introduce stochastic processes to capture volatility fluctuations in exchange rates, resulting in more sophisticated pricing.

Interest Rate Pricing Models

Term Structure Models: These models describe the relationship between interest rates and their maturities, enabling the pricing of bonds and other fixed income instruments.

Vasicek Model: This model assumes mean-reverting interest rates, providing a simple yet effective pricing framework.

Heath-Jarrow-Morton Model: This advanced model captures the dynamics of the entire yield curve, offering a comprehensive pricing approach.

Risk Management for FX and Interest Rate Portfolios

Risk management is equally crucial to safeguard portfolios from adverse market conditions. A robust risk management framework involves identifying, assessing, and mitigating risks.

FX Risk Management Techniques

Currency Diversification: Diversifying across multiple currencies reduces exposure to single-currency risks.

Hedging Strategies: Employing hedging instruments, such as forward contracts or options, can mitigate exchange rate risks.

Stress Testing: Simulating extreme market conditions helps assess portfolio resilience and identify potential vulnerabilities.

Interest Rate Risk Management Techniques

Duration Analysis: Measuring the sensitivity of portfolio value to interest rate changes provides insights into interest rate risk exposure.

Immunization Strategies: Matching portfolio duration to investment horizon can minimize interest rate risk.

Asset-Liability Management: Aligning asset and liability cash flows reduces interest rate risk by creating a natural hedge.

The Importance of Local and Global Perspectives

Effective pricing and risk management require a deep understanding of both local and global market dynamics. Local institutions need to consider country-specific factors, such as economic conditions, political stability, and regulatory frameworks. Global institutions, on the other hand, must navigate complex cross-bFree Download flows and currency fluctuations.

Understanding local and global perspectives allows institutions to tailor their pricing and risk management strategies to specific market environments, enhancing their effectiveness and resilience.

Pricing and risk management of FX and interest rate portfolios are essential disciplines for financial institutions to navigate the ever-changing financial landscape. By leveraging advanced pricing models and robust risk management techniques, institutions can accurately price instruments, mitigate risks, and optimize portfolio performance.

Embracing local and global perspectives enhances the effectiveness of pricing and risk management practices, empowering institutions to make informed decisions and achieve long-term success in the dynamic world of FX and interest rate portfolios.

4.4 out of 5

| Language | : | English |

| File size | : | 18443 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 498 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Nato Thompson

Nato Thompson Steve Englehart

Steve Englehart Mari Schuh

Mari Schuh Michal Oshman

Michal Oshman Michele G Kunz

Michele G Kunz Ruby Mosher

Ruby Mosher Patrice Leleu

Patrice Leleu Valerie Gilpeer

Valerie Gilpeer Rosanna Casper

Rosanna Casper Theodore B Sauselein

Theodore B Sauselein Nalini Singh

Nalini Singh Mark Bailey

Mark Bailey Richard Lecocq

Richard Lecocq Rebecca Henderson

Rebecca Henderson Tyler Feder

Tyler Feder Makiia Lucier

Makiia Lucier Michael Chandler

Michael Chandler Rodney Riesel

Rodney Riesel Vivian Chong

Vivian Chong Timothy Zahn

Timothy Zahn

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Andres CarterFollow ·15.1k

Andres CarterFollow ·15.1k Fabian MitchellFollow ·14.1k

Fabian MitchellFollow ·14.1k Ronald SimmonsFollow ·18.9k

Ronald SimmonsFollow ·18.9k Billy PetersonFollow ·2.1k

Billy PetersonFollow ·2.1k Alexandre DumasFollow ·19.7k

Alexandre DumasFollow ·19.7k Devin RossFollow ·15.1k

Devin RossFollow ·15.1k Troy SimmonsFollow ·17.4k

Troy SimmonsFollow ·17.4k Cameron ReedFollow ·19.1k

Cameron ReedFollow ·19.1k

Wayne Carter

Wayne CarterThe Beginner's Guide to Making an Old Motor Run Forever

If you're like most...

Deacon Bell

Deacon BellNepali Adventure: Kings and Elephant Drivers,...

In the heart of the...

Carlos Drummond

Carlos DrummondThe Romantic Revolution: A Journey Through History and...

Unveiling the...

Kazuo Ishiguro

Kazuo IshiguroUnlock Your Inner Innovator: Dive into the New Wave...

Embark on a Transformative Journey of...

William Golding

William GoldingCrazy Horse: The Lakota Warrior's Life and Legacy

In the annals of Native...

Hector Blair

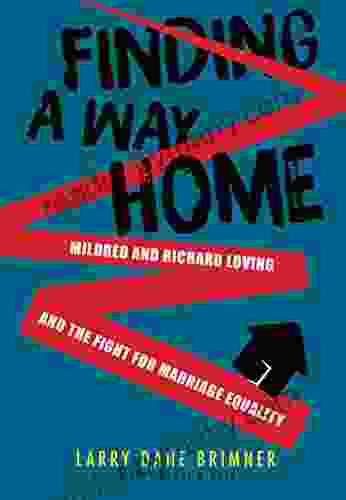

Hector BlairMildred and Richard Loving: The Inspiring Story of...

Mildred and Richard Loving were an...

4.4 out of 5

| Language | : | English |

| File size | : | 18443 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 498 pages |